Business

DRAM Prices Surge 171.8% Amid AI Demand and Market Skepticism

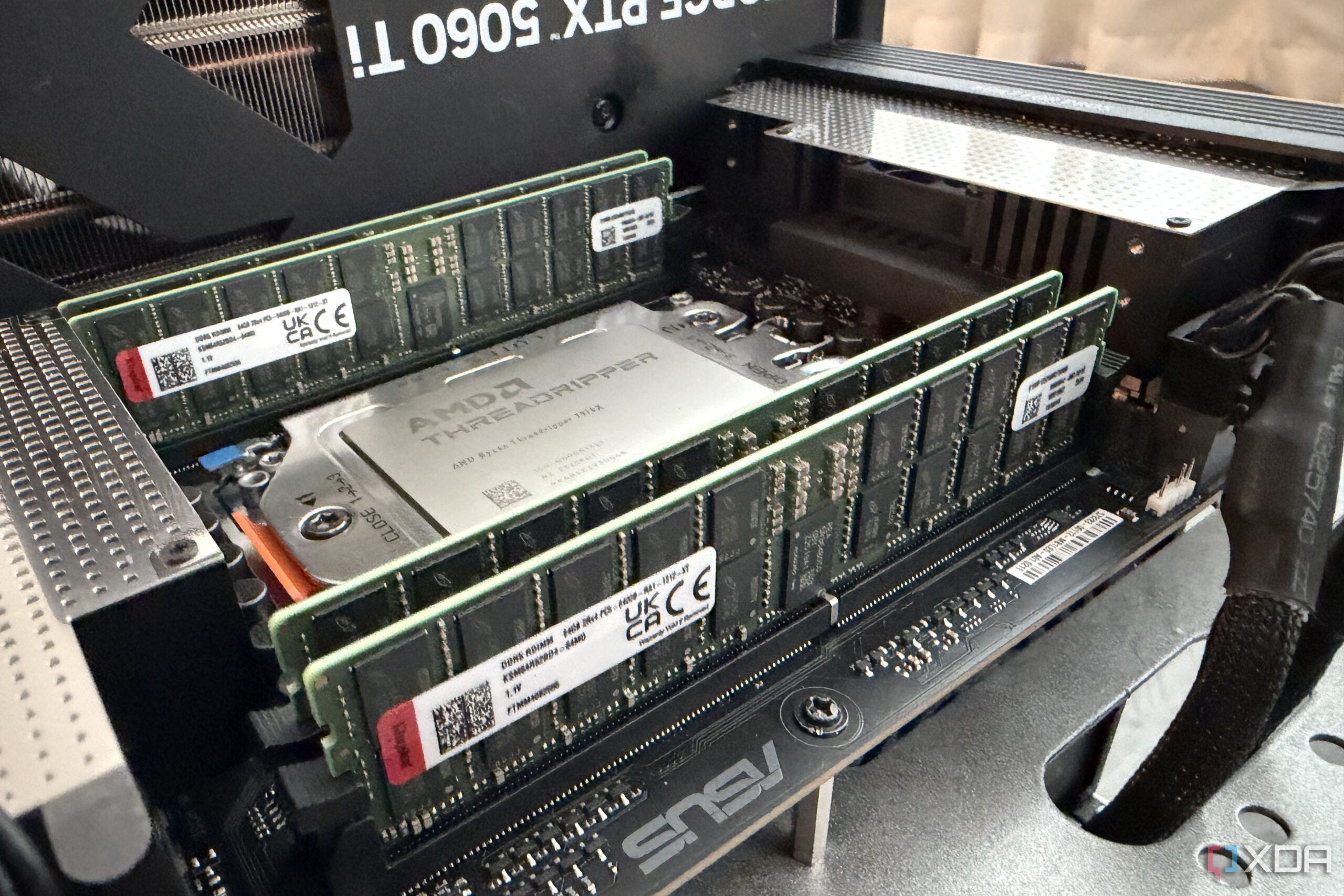

In a striking development, global DRAM prices have surged by an astonishing 171.8% in the third quarter of 2025, significantly outpacing the rising costs of gold. Industry officials attribute this spike primarily to skyrocketing demand from artificial intelligence (AI) data centers. Mainstream DDR5 memory modules now cost at least twice as much as they did earlier this year, leading to widespread concern among consumers and manufacturers alike.

The price increases are reverberating through the market, with a standard 32GB Corsair RAM kit on Amazon rising from $110 to a staggering $442 in just months. Such rapid price escalation has prompted retailers in regions such as Japan to ration sales of memory modules, reflecting a supply shortage that is expected to extend into 2026.

Understanding the Market Dynamics

Both DRAM and NAND flash memory prices are experiencing a simultaneous rise, as demand from major cloud providers pushes prices up by as much as 50% compared to the previous quarter. Analysts indicate that smaller buyers are receiving only 70% of the server memory they ordered, with larger firms prioritized in allocation due to their purchasing power.

For consumers looking to upgrade or build new PCs, the soaring RAM prices are a significant barrier. The cost of desktop DDR5 memory modules has approximately doubled in recent months, negating any potential savings from cheaper CPUs or GPUs. Even DDR4 modules are seeing price hikes as their production winds down, further complicating the situation for buyers.

Major manufacturers, including Samsung, SK Hynix, and Micron, are facing pressure not only from consumers but also from device producers, such as laptop and graphics card manufacturers, who are scrambling to secure RAM supplies. The Raspberry Pi Foundation has reported a need to increase prices of its models due to memory costs rising by 120% compared to the previous year.

AI Demand and Supply Constraints

The industry’s narrative centers on a “perfect storm” of booming demand driven by AI applications and constrained supply. For example, OpenAI’s recent projects reportedly require as much as 900,000 wafers of DRAM monthly, representing nearly 40% of global DRAM production. This unprecedented demand has led companies to pre-order substantial quantities of memory, with Micron stating they have essentially sold out their High Bandwidth Memory (HBM) output through 2026.

The supply chain is further complicated by a market dominated by just a few players, leading to concerns about potential price manipulation. The DRAM industry has a history of price-fixing, as seen in the early 2000s when multiple manufacturers, including the current leaders, faced legal repercussions for colluding to inflate prices.

While the current surge can be attributed to genuine market forces, the oligopolistic nature of the industry raises skepticism about the motivations of these companies. The major manufacturers have been cautious in ramping up production, driven by fears of an AI market bubble that could burst. This restraint allows them to maintain high prices, benefiting from the ongoing crisis.

In interviews, industry executives have hinted at severe shortages in NAND flash memory, with predictions of constrained supply lasting for up to a decade. The focus on high-margin products, such as HBM, further limits the production capacity available for standard DRAM.

Despite the legitimate demand from AI and cloud services, the current pricing environment suggests that memory manufacturers may be strategically maintaining high prices. The absence of aggressive competition to increase output raises concerns about whether the market is being manipulated for profit.

As the situation unfolds, the impact is being felt across various sectors. Companies like AMD are contemplating price increases for GPUs, and consumers are left wondering when relief from these high memory costs will arrive. With the potential for a prolonged period of high prices, it remains uncertain how the market will adapt to the changing landscape of demand and supply.

In conclusion, while the surge in DRAM prices can be partially justified by increased AI-related demand, the historical context of the industry suggests that skepticism is warranted. The intertwined dynamics of supply, demand, and potential price manipulation create a complex environment that could have lasting implications for consumers and businesses alike.

-

Science1 month ago

Science1 month agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Top Stories2 months ago

Top Stories2 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment2 months ago

Entertainment2 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Entertainment2 months ago

Entertainment2 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Top Stories1 month ago

Top Stories1 month agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast

-

Business2 months ago

Business2 months agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

Health2 months ago

Health2 months agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

World2 months ago

World2 months agoIsrael Reopens Rafah Crossing After Hostage Remains Returned

-

World2 months ago

World2 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Health2 months ago

Health2 months agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Entertainment2 months ago

Entertainment2 months agoRed Sox’s Bregman to Become Free Agent; Tigers Commit to Skubal