Business

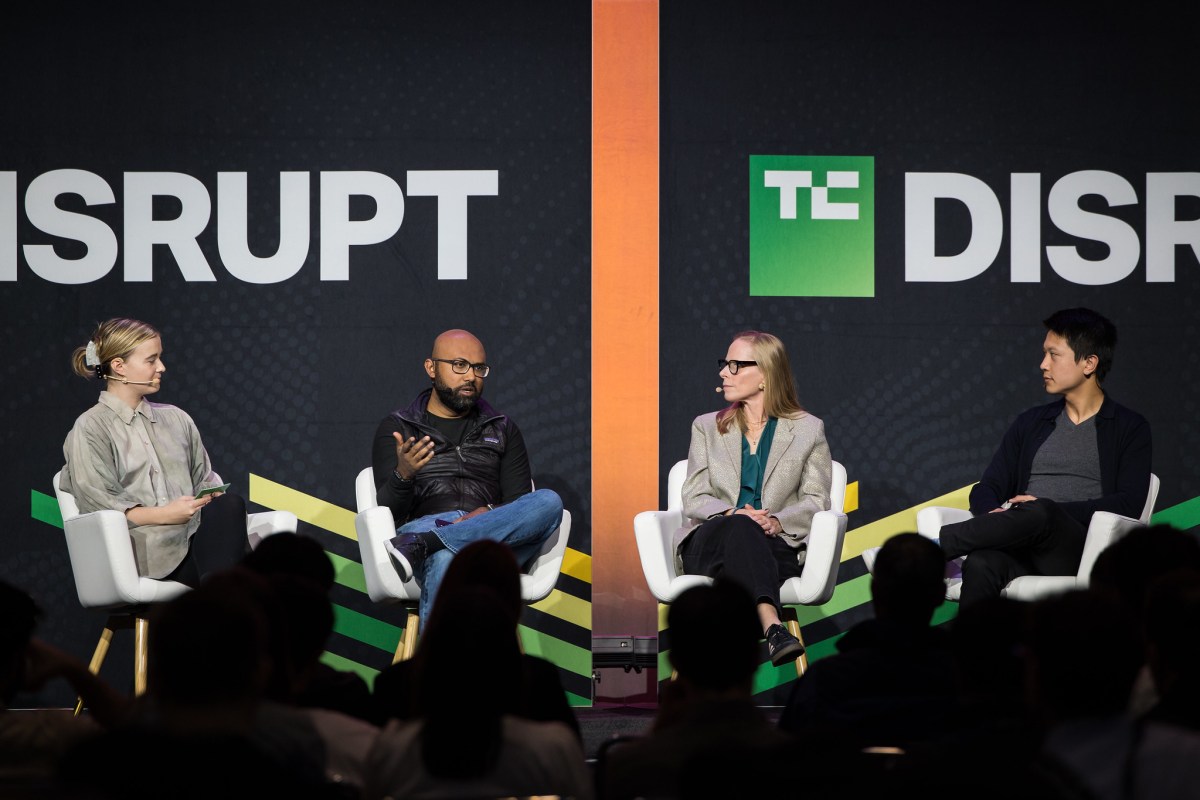

Founders Urged to Strategize Late-Stage Fundraising Early

Startup founders often focus on securing initial funding, but experts suggest this approach should extend to planning for future fundraising rounds. At TechCrunch Disrupt, Sadi Khan, co-founder and CEO of Aven, emphasized the importance of preparing for late-stage fundraising, including potential rounds like a $250 million Series D, from the outset.

Khan noted that understanding a startup’s capital requirements is crucial for long-term growth. “We’re a very capital-intensive company; we provide asset-backed credit cards to consumers,” he explained. “From day zero, we knew that we needed to have an intensive pipeline of investors that we want to work with over a long period of time.” By adopting this mindset early on, founders can identify the right investors for their initial funding while simultaneously nurturing relationships with those who will be key in later rounds.

Lila Preston, head of growth equity at Generation Investment Management, advocated for building these connections at least two years before seeking capital. Early engagement allows investors to gain insights into the business and its market dynamics, which can lead to more informed investment decisions. “When we show up, even at Series A or B, we’ve done the homework so that we’re an additive worthwhile conversation,” Preston stated, emphasizing the importance of articulating milestones and success metrics.

The need for early relationship-building is echoed by Zeya Yang, a partner at IVP. He highlighted the accelerating pace of later-stage fundraising, making it essential for founders to establish connections before they are in immediate need of funds. “It definitely helps to get to know those people earlier than you think you need to,” Yang said, noting that engaging with potential investors ahead of time enhances the overall fundraising process.

When startups reach out to later-stage investors, they do not need to disclose every financial detail immediately. Instead, they can share their vision and the general direction in which they are heading. This strategy allows for a more organic development of the relationship, creating a foundation for future discussions about funding.

Khan also recommended leveraging existing connections on a company’s cap table. Early investors can facilitate introductions to suitable venture capitalists, streamlining the process of finding the right partners for subsequent funding rounds. He shared his experience, noting how his early investors connected him to Khosla Ventures, which ultimately led to Aven’s Series E round.

In conclusion, startup founders are encouraged to adopt a long-term perspective on fundraising. By considering late-stage funding needs from the very beginning, they not only secure necessary resources for growth but also build robust relationships with potential investors. This proactive approach can significantly influence the trajectory of a startup’s success.

The upcoming TechCrunch Disrupt event, scheduled for October 13-15, 2026, will feature industry leaders and provide valuable networking opportunities for startups looking to refine their fundraising strategies.

-

Science3 weeks ago

Science3 weeks agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Health4 weeks ago

Health4 weeks agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Top Stories4 weeks ago

Top Stories4 weeks agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment4 weeks ago

Entertainment4 weeks agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Business4 weeks ago

Business4 weeks agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

Entertainment4 weeks ago

Entertainment4 weeks agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Health4 weeks ago

Health4 weeks agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

World4 weeks ago

World4 weeks agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Entertainment4 weeks ago

Entertainment4 weeks agoRed Sox’s Bregman to Become Free Agent; Tigers Commit to Skubal

-

Health4 weeks ago

Health4 weeks agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Science4 weeks ago

Science4 weeks agoNorth Carolina’s Biotech Boom: Billions Invested in Manufacturing

-

Top Stories4 weeks ago

Top Stories4 weeks agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast