Business

Tesla’s Energy Storage Revenue Soars 44% in Q3, Redefining Growth

Tesla Inc. (NASDAQ:TSLA) has reported a significant rise in its energy storage revenue, which increased by 44% year over year, reaching $3.4 billion in the third quarter of 2023. This growth now represents 12% of the company’s total sales, up from 9% a year earlier. While Tesla is widely known for its electric vehicles (EVs), this surge in energy storage underscores a pivotal shift in its business model towards becoming a diversified energy company.

Transforming the Energy Landscape

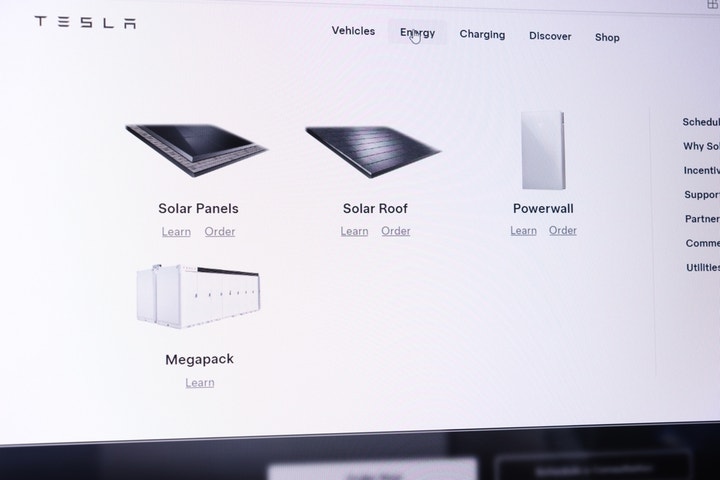

At the heart of this transformation is Tesla’s utility-scale storage system, the Megapack. Utilities around the globe are increasingly adopting Megapacks to stabilize their grids, integrate renewable energy sources, and achieve ambitious carbon-reduction goals. This transition is vital as the demand for sustainable energy solutions continues to rise. Although Tesla’s EV margins face cyclical pressures, the robust growth in energy storage is outpacing the company’s overall revenue increase, indicating a sustainable, high-margin business that extends beyond the automotive sector.

On the residential side, the Powerwall is gaining traction among homeowners seeking energy independence and solar integration. With the potential for AI-driven energy optimization through Tesla’s Dojo supercomputer, these systems may soon manage entire microgrids effectively, offering Tesla recurring revenue streams. Analysts project that if this growth trend continues, Tesla’s energy storage revenue could exceed $10 billion annually by 2027, marking a significant milestone for the company.

A Strategic Hedge Against Market Cyclicality

Tesla’s success in the energy sector is not merely about impressive growth figures; it serves as a strategic hedge against the cyclical nature of the automotive market. The integration of AI, vertical integration, and global scaling within its energy storage segment positions Tesla as a frontrunner in what could be described as its “next big thing.” This development offers a fresh narrative for investors, moving beyond the traditional focus on EV deliveries and Full Self-Driving (FSD) technology.

While discussions surrounding Tesla often center on innovations like Robotaxis and the Optimus humanoid robot, the energy storage segment is quietly fueling the company’s long-term potential. For investors, the rise of Megapacks and Powerwalls strengthens the argument that Tesla is evolving from a mere car manufacturer into an AI-enabled energy infrastructure leader. This evolving landscape may be the most compelling reason for stakeholders to monitor this stock closely as it continues to navigate its ambitious goals.

-

Science4 days ago

Science4 days agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Top Stories1 week ago

Top Stories1 week agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment1 week ago

Entertainment1 week agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Business1 week ago

Business1 week agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

World1 week ago

World1 week agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Entertainment1 week ago

Entertainment1 week agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Science1 week ago

Science1 week agoNorth Carolina’s Biotech Boom: Billions Invested in Manufacturing

-

Health1 week ago

Health1 week agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

Health1 week ago

Health1 week agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Health1 week ago

Health1 week agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Entertainment1 week ago

Entertainment1 week agoRed Sox’s Bregman to Become Free Agent; Tigers Commit to Skubal

-

Top Stories6 days ago

Top Stories6 days agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast