Top Stories

Amgen Shares Drop 0.07% as Investors Eye P/E Ratio Urgently

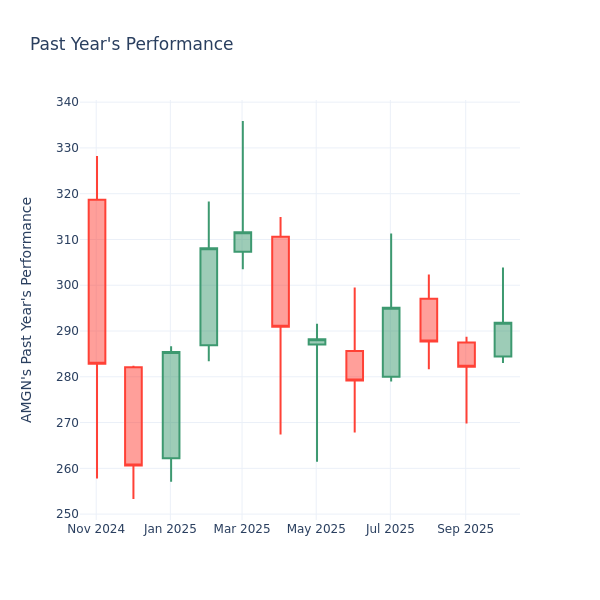

UPDATE: Amgen Inc. (NASDAQ:AMGN) is experiencing a slight decline in its stock price, trading at $291.80 after a 0.07% drop in today’s session. As the biotech giant faces these challenges, investors are urgently reassessing the company’s price-to-earnings ratio amidst a broader market analysis.

In the past month, Amgen’s stock has fallen by 2.04%, and over the last year, it has decreased by 7.92%. These figures are raising concerns among long-term shareholders who are now closely examining the company’s financial indicators to gauge future performance.

Investors often utilize the price-to-earnings (P/E) ratio to compare a company’s market performance against industry standards and historical earnings. Currently, Amgen’s P/E ratio is lower than the aggregate P/E of 152.02 in the Biotechnology industry. This discrepancy suggests that shareholders may either expect poorer performance or that Amgen could be undervalued in the current market.

Despite the potential for undervaluation, a low P/E can also indicate weak growth prospects or financial instability, highlighting the need for caution. Investors should not rely solely on the P/E ratio; it is imperative to analyze a range of metrics and industry trends to gain a comprehensive view of Amgen’s financial health.

As Amgen grapples with these market fluctuations, analysts emphasize the importance of a holistic approach to investment decisions. With a focus on various financial ratios and qualitative factors, investors can better navigate the complexities of the biotech sector.

Stay tuned for more updates on Amgen’s stock performance and the implications for stakeholders as the situation develops. Investors are advised to monitor this closely, as the biotech landscape continues to shift rapidly.

-

Science2 weeks ago

Science2 weeks agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Top Stories2 weeks ago

Top Stories2 weeks agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Business2 weeks ago

Business2 weeks agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

Entertainment2 weeks ago

Entertainment2 weeks agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

World2 weeks ago

World2 weeks agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Health2 weeks ago

Health2 weeks agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

Health2 weeks ago

Health2 weeks agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Entertainment2 weeks ago

Entertainment2 weeks agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Health2 weeks ago

Health2 weeks agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Entertainment2 weeks ago

Entertainment2 weeks agoRed Sox’s Bregman to Become Free Agent; Tigers Commit to Skubal

-

Science2 weeks ago

Science2 weeks agoNorth Carolina’s Biotech Boom: Billions Invested in Manufacturing

-

Top Stories2 weeks ago

Top Stories2 weeks agoDisney+ Launches Chilling Classic ‘Something Wicked’ Just in Time for October