Top Stories

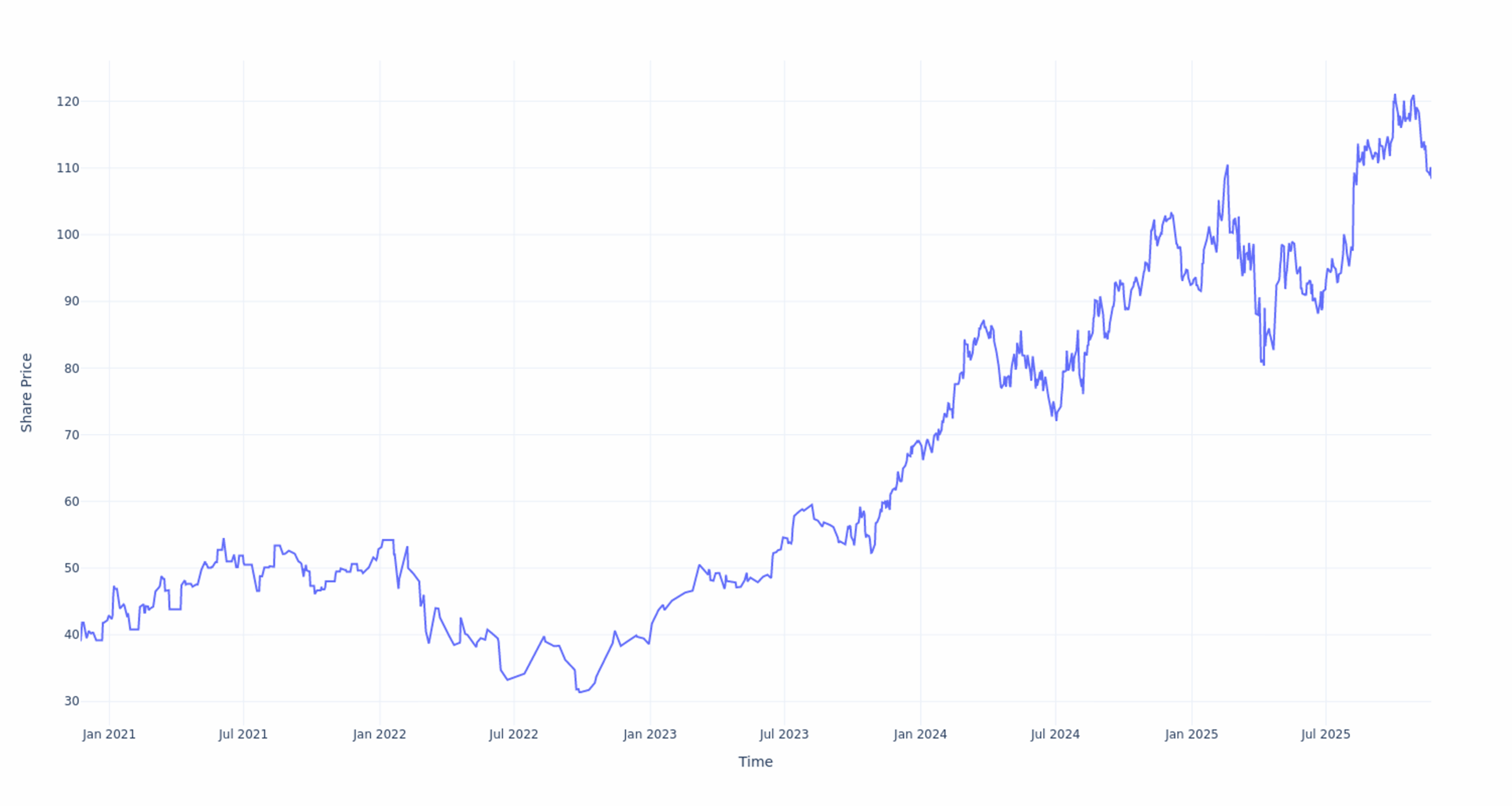

CRH Stock Surges 21.19% Over 5 Years: What Investors Need to Know Now

UPDATE: New data reveals that CRH (NYSE:CRH) has achieved an impressive annualized return of 21.19% over the past 5 years, outperforming the broader market by 8.76%. This surge in performance is catching the attention of investors as CRH’s market capitalization now stands at a robust $72.57 billion.

If you had invested $100 in CRH stock five years ago, your investment would be worth an astonishing $277.69 today, based on the current trading price of $108.37. This remarkable growth highlights the impact of compounded returns, which can significantly boost cash growth over time.

The latest figures underscore the potential for long-term investments in the stock market, particularly for those considering entry into the construction and materials sector, where CRH operates. As investors seek opportunities for growth, CRH’s robust performance provides a compelling case for consideration.

Analysts are urging potential investors to take note of CRH’s upward trajectory. The company’s consistent returns and solid market position signal a promising future. Investors should closely monitor CRH’s developments as the market reacts to this news.

For those who are contemplating investing in CRH or similar stocks, understanding the power of compound growth is essential. The substantial increase in value over five years is a testament to the effectiveness of long-term investment strategies.

As more investors look to capitalize on these gains, the question remains: will CRH continue this upward trend? Stay tuned for further updates and insights into the stock’s performance as it unfolds.

This information is based on data reviewed by Benzinga, which does not provide investment advice. Make sure to share this article with fellow investors who may benefit from these insights.

-

Science1 month ago

Science1 month agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Top Stories2 months ago

Top Stories2 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment2 months ago

Entertainment2 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Entertainment2 months ago

Entertainment2 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Top Stories1 month ago

Top Stories1 month agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast

-

Health2 months ago

Health2 months agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

Business2 months ago

Business2 months agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

World2 months ago

World2 months agoIsrael Reopens Rafah Crossing After Hostage Remains Returned

-

World2 months ago

World2 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Health2 months ago

Health2 months agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Health2 months ago

Health2 months agoYouTube Launches New Mental Health Tools for Teen Users