Business

Morgan Stanley Raises Micron Price Target to $350 Following Strong Earnings

Micron Technology’s recent quarterly results have prompted Morgan Stanley to raise its price target for the semiconductor company to $350 from $338. This follows what the firm described as one of the most significant revenue and profit surprises in the history of the U.S. chip industry, second only to the surge experienced by Nvidia driven by artificial intelligence (AI) demand.

In its latest earnings report, Micron delivered a double beat for the third consecutive quarter, showcasing a remarkable performance that has seen the stock soar by 109% over the past six months and 200% year-to-date. At the time of writing, Micron’s stock was trading around $254, indicating a potential upside of nearly 38% from the new target.

Micron’s guidance for the upcoming quarters has reset expectations across the memory chip market. The company is forecasting earnings of over $8 per share, which is approximately double what analysts had anticipated. This reflects a shift in memory pricing power, largely driven by the growing demand for AI technology.

Micron’s Role in the AI Ecosystem

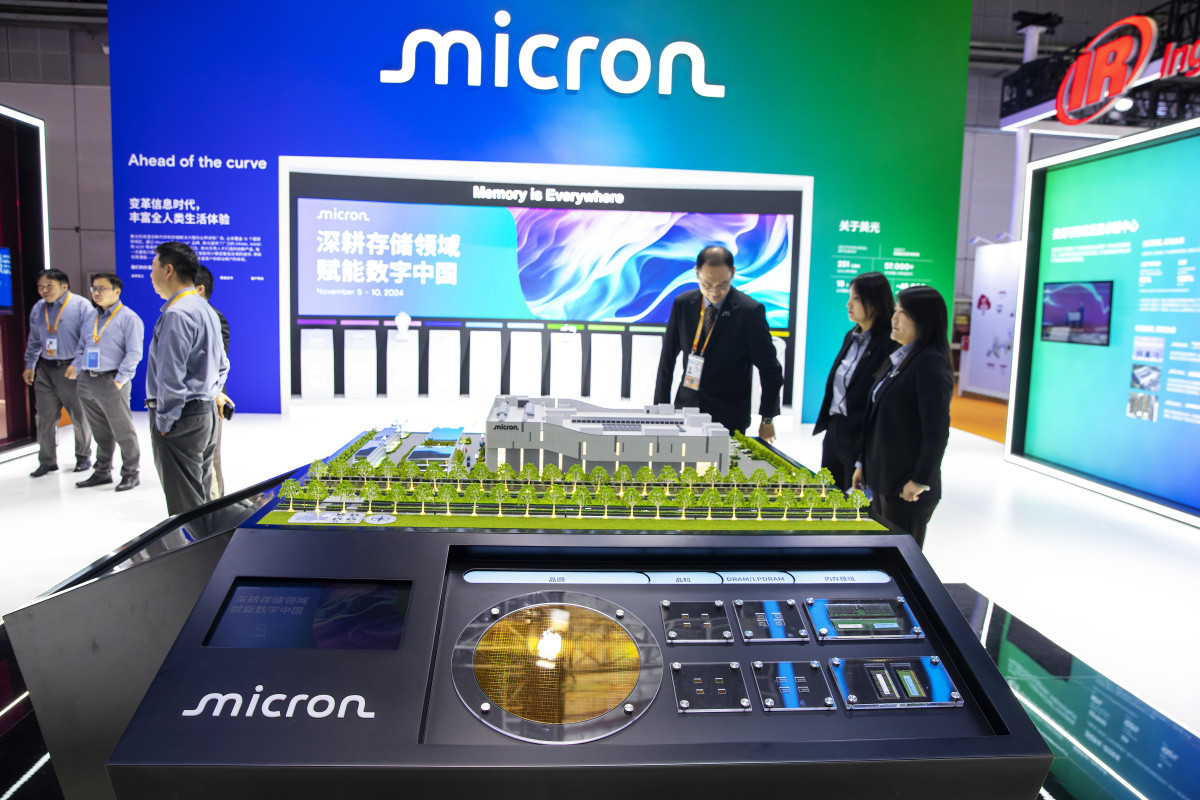

Micron Technology specializes in the production of memory chips, which are crucial for the functioning of AI systems. While Nvidia’s graphics processing units (GPUs) serve as the “brains” of computing, Micron’s memory chips provide the necessary short-term and long-term storage. This allows AI systems to handle vast amounts of data efficiently.

The company manufactures two principal products: DRAM and NAND. DRAM is akin to short-term memory, functioning quickly and commanding premium pricing. In contrast, NAND serves as long-term storage, holding large volumes of data such as cloud files and images. Micron’s distinct advantage lies in its AI-specific memory solutions, which are increasingly required in modern AI data centers.

For instance, AI servers can contain as much as 2 TB of RAM, significantly more than the 256 GB found in standard general-purpose servers. This demand for enhanced memory capacity highlights the critical role Micron plays in the AI hardware ecosystem.

Morgan Stanley analyst Joseph Moore emphasized that the firm’s assessment of Micron’s results goes beyond merely beating expectations; it reflects a significant reset of those expectations. He noted that Micron’s guidance was billions of dollars above consensus estimates, suggesting a structural change in the memory market.

Long-Term Optimism and Market Dynamics

Micron’s recent quarterly performance has galvanized analysts to adjust their price targets, underscoring the narrative of an “AI memory shortage.” Several firms have revised their targets significantly. Needham increased its price target to $300 from $200, while Wedbush also raised its target to $300, both projecting about 33% upside potential. KeyBanc set its target at $325, indicating a 44% upside based on robust AI-driven demand.

In light of these developments, Micron’s CEO Sanjay Mehrotra stated that the AI-driven memory shortage is not just a temporary spike but a multi-year structural challenge. He revised the company’s high-bandwidth memory (HBM) market forecast to nearly $100 billion by 2028, up from earlier estimates of $35 billion in 2025.

Mehrotra’s comments indicate that Micron’s clients are increasingly viewing memory as a strategic resource rather than a commodity. Currently, Micron can only satisfy 50% to two-thirds of demand from key customers, emphasizing the tightening supply situation and the company’s enhanced pricing power.

As Micron continues to navigate this evolving landscape, its recent results and optimistic outlook are likely to remain a focal point for investors and analysts alike. The company’s ability to adapt to the demands of the AI market will be crucial in maintaining its competitive edge in the fast-paced semiconductor industry.

-

Science2 months ago

Science2 months agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Top Stories2 months ago

Top Stories2 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment2 months ago

Entertainment2 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Health2 months ago

Health2 months agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

Top Stories2 months ago

Top Stories2 months agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast

-

Entertainment2 months ago

Entertainment2 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

World2 months ago

World2 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

World2 months ago

World2 months agoIsrael Reopens Rafah Crossing After Hostage Remains Returned

-

Health2 months ago

Health2 months agoYouTube Launches New Mental Health Tools for Teen Users

-

Business2 months ago

Business2 months agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

Entertainment2 months ago

Entertainment2 months agoRed Sox’s Bregman to Become Free Agent; Tigers Commit to Skubal