Business

Euro Weakens to 1.1785 Ahead of ECB Interest Rate Decision

The Euro (EUR) declined against the US Dollar (USD), trading at approximately 1.1785 during early European hours on Thursday, March 14, 2024. This movement comes ahead of a significant interest rate decision by the European Central Bank (ECB) and follows a notable drop in Eurozone inflation, which fell well below the ECB’s target.

As the market anticipates the ECB’s announcement, analysts expect the central bank to maintain its benchmark interest rate at its February meeting. The latest data from Eurostat revealed that the Eurozone Harmonized Index of Consumer Prices (HICP) inflation eased to 1.7% year-on-year in January, down from 1.9% in December. The core HICP remained unchanged at 2.3% year-on-year. These figures, which align with expectations, have intensified speculation regarding potential future rate cuts by the ECB, placing additional downward pressure on the Euro.

Market Sentiment Ahead of ECB Meeting

In the lead-up to the ECB’s decision, market participants are particularly focused on the implications of the central bank’s communication strategy. Bank of America analysts noted that the emphasis during the upcoming press conference led by ECB President Christine Lagarde will likely center on “higher uncertainty,” suggesting only minor changes in guidance. They indicated, “Our conviction in a March cut is not rock solid, but we remain convinced of an easing bias from here.”

In addition to the ECB’s meeting, traders are also awaiting other economic indicators, including German Factory Orders and Eurozone Retail Sales, which will be released later on Thursday. The outcomes of these reports could further influence market dynamics and expectations surrounding the ECB’s monetary policy.

Broader Economic Context

Across the Atlantic, concerns regarding the independence of the US Federal Reserve could impact the strength of the US Dollar. On March 14, 2024, US President Donald Trump remarked that he might have chosen not to nominate Kevin Warsh to lead the Fed had Warsh indicated a desire to raise interest rates. Such statements may create uncertainties that could provide some support for the Euro against the Dollar.

The EUR/USD pair’s performance is also influenced by speculation surrounding the ECB’s quantitative easing (QE) measures. In situations where inflation remains stubbornly low, the central bank can resort to QE as a means of economic stimulus. This policy involves purchasing government and corporate bonds to increase liquidity in the market, typically resulting in a weaker Euro. The ECB has employed QE during various economic crises, including the Great Financial Crisis and the COVID-19 pandemic.

As the ECB meeting approaches, the Euro’s trajectory will largely depend on the central bank’s assessment of inflation trends and future economic conditions. With inflation in the Eurozone undershooting expectations, market participants remain vigilant, anticipating updates that could shape monetary policy in the coming months.

The outcome of the ECB’s decision and President Lagarde’s comments will be closely scrutinized, as traders seek clarity on the future direction of interest rates and economic growth within the Eurozone.

-

Science2 months ago

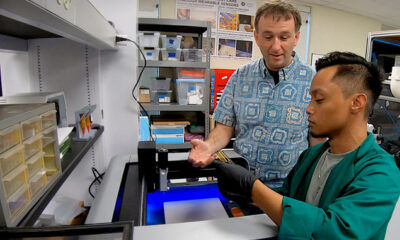

Science2 months agoResearchers Launch $1.25M Project for Real-Time Hazard Monitoring in Hawaiʻi

-

Science4 months ago

Science4 months agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Top Stories4 months ago

Top Stories4 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment4 months ago

Entertainment4 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

World4 months ago

World4 months agoUK Government Borrowing Hits £20.2 Billion in September Surge

-

Health4 months ago

Health4 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Entertainment4 months ago

Entertainment4 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Entertainment4 months ago

Entertainment4 months agoOlivia Plath Opens Up About Her Marriage Struggles and Divorce

-

Science3 months ago

Science3 months agoAI Gun Detection System Mistakes Doritos for Weapon, Sparks Outrage

-

World4 months ago

World4 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Health4 months ago

Health4 months agoYouTube Launches New Mental Health Tools for Teen Users

-

Top Stories4 months ago

Top Stories4 months agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast