Business

Sequoia Capital Launches $950M in New Funds to Back Startups

Sequoia Capital has announced the launch of two new funds totaling $950 million, aimed at early-stage investments in startups. The announcement, made on October 23, 2023, includes a $750 million fund focused on Series A investments and a $200 million seed fund. This move underscores the firm’s commitment to identifying and supporting innovative founders, despite ongoing discussions about a potential bubble in the artificial intelligence (AI) sector.

According to Bogomil Balkansky, a partner in Sequoia’s early-stage investment team, the firm remains steadfast in its investment strategy. “Markets go up and down, but our strategy remains consistent. We’re always looking for outlier founders with ideas to build generational businesses,” he stated. Sequoia aims to capitalize on early opportunities, particularly as startup valuations in the AI space have surged.

The introduction of the new funds comes after a challenging period for Sequoia. The firm restructured its operations in 2021 to create an evergreen main fund supported by various strategy-specific “sub-funds.” This change was primarily intended to allow Sequoia to retain equity in portfolio companies long after their initial public offerings (IPOs). However, the firm faced significant setbacks, including a loss of over $200 million from its investment in the collapsed cryptocurrency exchange FTX in late 2022. Additionally, Sequoia separated from its divisions in India and China in 2023, further complicating its operations.

The firm, known for its early support of companies like Airbnb, Google, Nvidia, and Stripe, is now refocusing on its core mission: investing in promising founders at the earliest stages. Balkansky highlighted this commitment, stating, “Our ambition has always been and continues to be to identify these founders as early as possible; to roll up our sleeves and be a very active participant in their company-building journey.”

With the rapid rise in valuations of AI startups, Sequoia plans to leverage its new funds to invest in some of the most promising early-stage founders. This approach not only allows the firm to secure a lower entry price but also enables it to obtain substantial ownership stakes in these companies. Recent investments in startups such as Clay, Harvey, n8n, Sierra, and Temporal have already seen significant returns during the ongoing AI boom.

Balkansky emphasized Sequoia’s intention to enhance its reputation by investing even earlier in the startup lifecycle, targeting what is now referred to as the pre-seed stage. The firm has already made initial investments in companies like Xbow, a security testing startup, and Traversal, an AI reliability engineering firm, both of which have attracted substantial follow-on investments at higher valuations.

Sequoia’s commitment to supporting its portfolio companies extends beyond capital. The firm has played an active role in helping its startups grow by facilitating strategic connections. For instance, it arranged for Xbow to add a former Databricks Chief Revenue Officer to its board and connected Traversal with over 30 potential customers. Furthermore, a meeting between Reflection AI and Nvidia‘s CEO Jensen Huang led to a significant $500 million investment from the chipmaker.

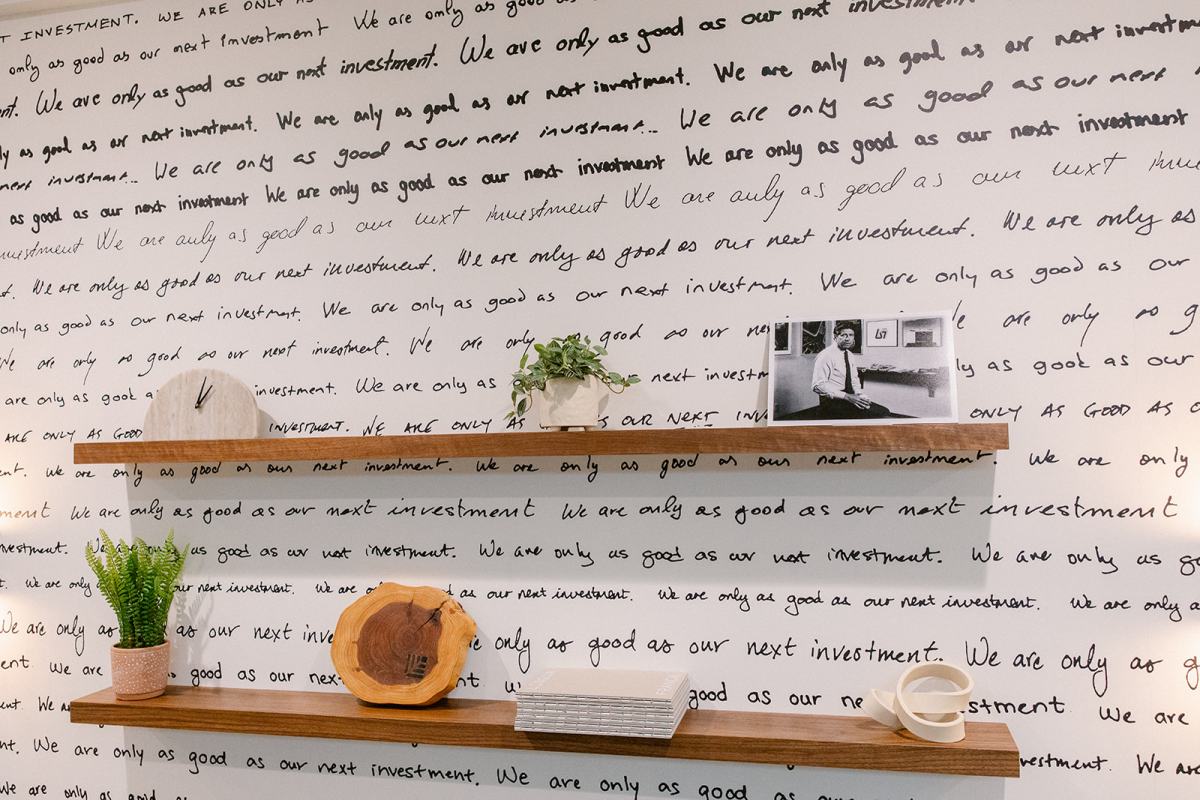

Despite these challenges and successes, Sequoia remains focused on preserving its legacy as a leading investor in Silicon Valley. To foster this mindset among its team, the firm’s newly renovated office features a wall inscribed with a powerful reminder: “We are only as good as our next investment.”

As Sequoia Capital embarks on this new chapter with its fresh funding, the firm is poised to continue its long-standing tradition of identifying and cultivating the next generation of groundbreaking entrepreneurs.

-

Science2 months ago

Science2 months agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Top Stories2 months ago

Top Stories2 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment2 months ago

Entertainment2 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

Health2 months ago

Health2 months agoCurium Group, PeptiDream, and PDRadiopharma Launch Key Cancer Trial

-

World2 months ago

World2 months agoIsrael Reopens Rafah Crossing After Hostage Remains Returned

-

Top Stories2 months ago

Top Stories2 months agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast

-

Entertainment2 months ago

Entertainment2 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

World2 months ago

World2 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy

-

Business2 months ago

Business2 months agoTyler Technologies Set to Reveal Q3 Earnings on October 22

-

Health2 months ago

Health2 months agoNorth Carolina’s Biotech Boom: Billions in New Investments

-

Health2 months ago

Health2 months agoYouTube Launches New Mental Health Tools for Teen Users