Sports

Citigroup Lowers Price Target for IQVIA to $200 Amid Market Adjustments

Analysts at Citigroup have reduced their price target for IQVIA (NYSE: IQV) from $230.00 to $200.00, according to a report released on February 2, 2024. The brokerage now maintains a “neutral” rating on the medical research company’s stock, suggesting a potential upside of 6.87% based on its previous closing price.

Several other financial institutions have also recently provided insights into IQVIA’s stock performance. For instance, Wall Street Zen upgraded IQVIA from a “hold” rating to a “buy” rating on January 25, 2024. Meanwhile, Evercore ISI reaffirmed its “outperform” rating and established a price target of $225.00 on January 31. TD Cowen increased its target price from $215.00 to $245.00 and assigned a “hold” rating on January 22, while Weiss Ratings reiterated a “hold (c)” rating on the same day. Truist Financial projected a higher price target of $290.00 with a “buy” rating on January 8.

Currently, analysts have rated IQVIA with two “Strong Buy” ratings, eleven “Buy” ratings, and four “Hold” ratings. According to MarketBeat.com, the consensus rating stands at “Moderate Buy,” with an average price target of $243.63.

Recent Financial Performance and Guidance

IQVIA’s quarterly earnings report, released on February 5, 2024, revealed an earnings per share (EPS) of $3.42, surpassing analysts’ expectations of $3.40 by $0.02. The company achieved a net margin of 8.07% and a return on equity of 30.70%. Revenue for the quarter reached $4.36 billion, exceeding the anticipated $4.24 billion. This represented a year-over-year revenue growth of 10.3%, compared to $3.12 EPS from the same quarter the previous year. Looking ahead, IQVIA has set its fiscal year 2026 guidance at an EPS range of 12.550–12.850.

Equities research analysts project an EPS of 10.84 for the current fiscal year.

Institutional Investment Changes

Recent moves by hedge funds and institutional investors have also influenced IQVIA’s stock dynamics. Brighton Jones LLC significantly increased its stake in IQVIA, boosting its holdings by 244.4% during the fourth quarter, now owning 3,575 shares valued at $703,000. Empowered Funds LLC raised its position in IQVIA by 102.1% in the first quarter, acquiring 9,728 shares valued at $1.715 million. Other notable changes included Sivia Capital Partners LLC acquiring a new position worth $514,000 and DAVENPORT & Co LLC increasing its stake by 6.7%.

Currently, hedge funds and institutional investors collectively hold 89.62% of IQVIA’s shares.

Market Sentiment and Outlook

Market reactions to IQVIA’s recent performance have displayed mixed sentiment. Positive indicators include the company’s strong Q4 results, where both EPS and revenue exceeded expectations, supporting recovery efforts within the pharmaceutical sector. Furthermore, IQVIA’s FY 2026 guidance aligns closely with consensus estimates, providing a solid foundation for anticipated recovery.

Contrarily, some analysts expressed concerns regarding the projected annual profit outlook, which has been affected by rising interest expenses. Reports from Reuters and other outlets indicate that while the revenue forecast is robust, certain earnings expectations fell short of Wall Street estimates, leading to intraday selling pressures. Analysts have also raised questions about the near-term impact of IQVIA’s artificial intelligence strategy, with one firm, BTIG, downgrading its rating to neutral, adding further downward pressure on stock performance.

IQVIA operates as a global provider of advanced analytics, technology solutions, and contract research services within the life sciences sector. The company emerged from the merger of Quintiles and IMS Health in 2016 and has since established itself as a leader in clinical development services, regulatory reporting, and data analytics.

As IQVIA navigates these challenges and opportunities, investors will be closely monitoring the company’s strategic initiatives and their implications for future growth.

-

Science2 months ago

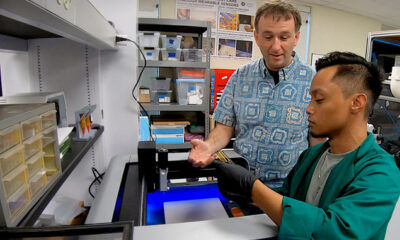

Science2 months agoResearchers Launch $1.25M Project for Real-Time Hazard Monitoring in Hawaiʻi

-

Science4 months ago

Science4 months agoInventor Achieves Breakthrough with 2 Billion FPS Laser Video

-

Top Stories4 months ago

Top Stories4 months agoCharlie Sheen’s New Romance: ‘Glowing’ with Younger Partner

-

Entertainment4 months ago

Entertainment4 months agoDua Lipa Aces GCSE Spanish, Sparks Super Bowl Buzz with Fans

-

World4 months ago

World4 months agoUK Government Borrowing Hits £20.2 Billion in September Surge

-

Health4 months ago

Health4 months agoCommunity Unites for 7th Annual Into the Light Walk for Mental Health

-

Entertainment4 months ago

Entertainment4 months agoMother Fights to Reunite with Children After Kidnapping in New Drama

-

Entertainment4 months ago

Entertainment4 months agoOlivia Plath Opens Up About Her Marriage Struggles and Divorce

-

Science3 months ago

Science3 months agoAI Gun Detection System Mistakes Doritos for Weapon, Sparks Outrage

-

Top Stories4 months ago

Top Stories4 months agoFormer Mozilla CMO Launches AI-Driven Cannabis Cocktail Brand Fast

-

Entertainment4 months ago

Entertainment4 months agoSkrilla and Lil Yachty Drop New Track “Rich Sinners” Ahead of Release

-

World4 months ago

World4 months agoR&B Icon D’Angelo Dies at 51, Leaving Lasting Legacy